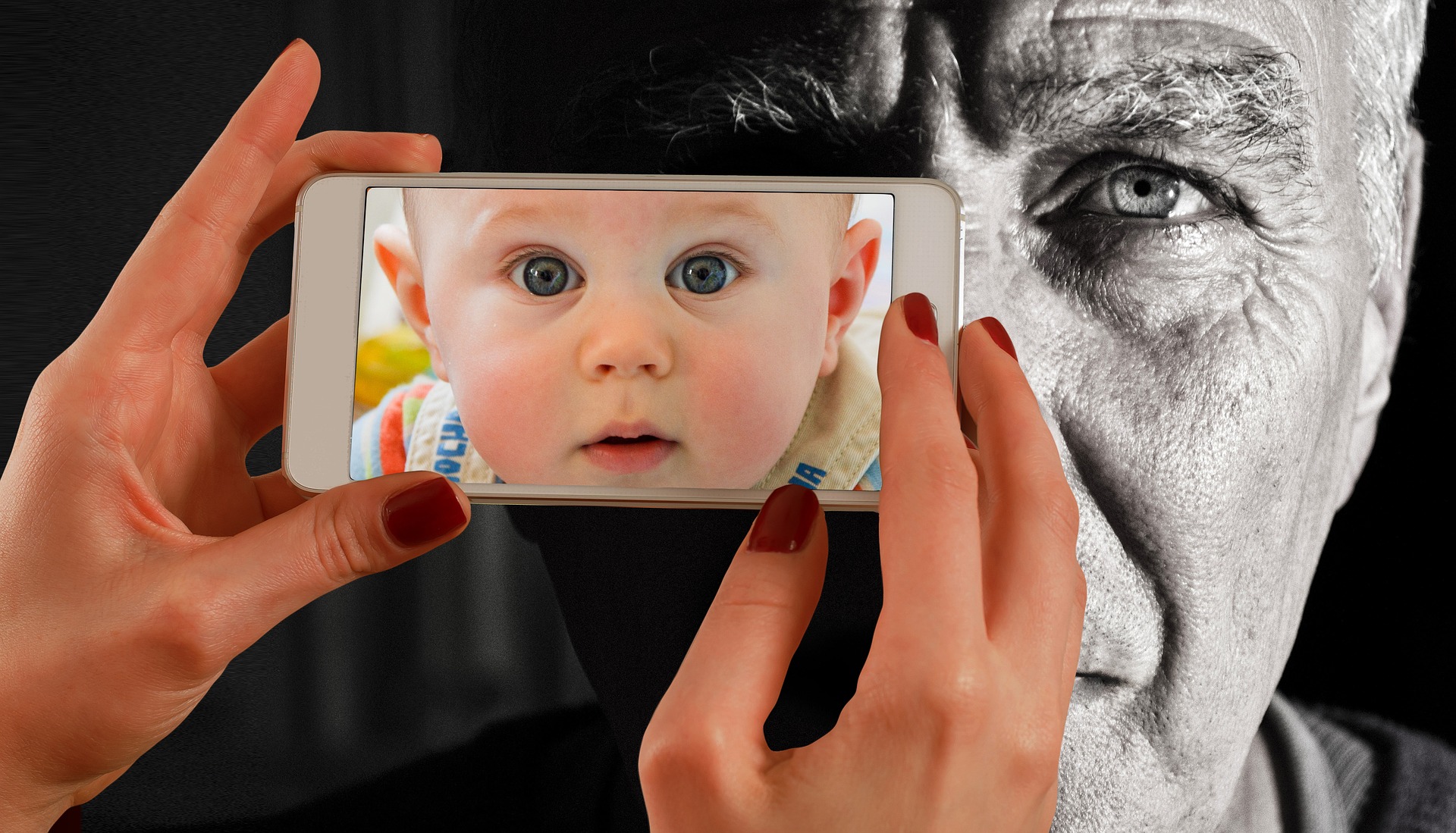

As we age, our financial acuity drops by one percentage every year after we turn 60. The irony is that, as our financial acuity drops, our financial confidence actually increases. The older we get, the bigger the gap between our actual skills and what we think we can do. This disconnect oftentimes leads us to make less than ideal financial decisions, leads us into sub-optimal financial situations, and also makes it easier for others to take financial advantage of us…without us even realizing it.

Here are some tips for how to proactively age-proof our finances, so we aren’t taken by surprise in the future.

1. Exercise. Studies show that physical exercise improves mental acuity. Exercise multiple days every week to keep your brain sharp!

2. Get a SPIA. A Single Premium Immediate Annuity (SPIA) is a contract with an insurance company. You pay them a sum of money up front, known as a premium, and they promise to pay you a certain amount of money periodically for the rest of your life.

3. Hire a financial advisor. Having someone who can look over your finances and make professional suggestions is a surefire way to keep your financials on track. An advisor will also save you money in the long run, by telling you which risks to take…and when to play it safe.

4. Open a trust. Set up a living trust that will assign your assets to a trustee in the event you make a bad financial decision. Deliberato Law Center offers a free consultation for anyone considering setting up a trust.

5. Invest in a fund. Get a low cost index fund from Vanguard or Fidelity. These funds will manage risks for you, and choose the best stocks to invest in during the ups and downs of the market.

Remember, don’t make any financial decisions without consulting with your attorney or financial advisor. At Deliberato Law center, we believe in the power of partnership. Your legal, financial, and tax consultants must all work together—or it won’t work at all!